Incentives for Business in South Georgia

Ranked the #1 State for Business by both Area Development magazine (2013-2023) and Site Selection magazine (2012-2020), Georgia offers a full slate of business incentives and tax exemptions. Locally, businesses can enjoy rapid decision making, streamlined permitting, collaborative partnerships, low costs, easy access to global markets, a welcoming community, less competition, and an opportunity to create immediate impact.

Local Assistance

Our partner organizations in the 22 counties of Locate South Georgia offer various incentives that may be exactly what your business needs.

These incentives may include:

- Property tax abatements

- Land incentives

- Industrial Revenue Bonds

- Revolving Loan Funds

- Freeport Exemption

- Engineering services assistance

- New Market Tax Credit

- Fast-track permitting

- Permitting and Infrastructure financial assistance

- Build to Suit/lease-back arrangements

- Waived utility fees/reduced utility costs

Statewide Incentive Programs

There are numerous incentive programs administered by various departments of Georgia’s state government that are designed to lessen the tax burden and overall cost of doing business for companies locating, relocating or expanding in Georgia.

These include:

- Georgia’s low corporate income tax, now 5.75%

- Georgia's Quick Start, world-class, customized training for new and expanding industries and businesses at no cost to qualifying businesses

- Georgia's Intellectual Capital Partnership from the University of Georgia System

- Entrepreneur and Small Business Loan Guarantee Program

- The six Centers of Innovation throughout the state offer technology-oriented support to businesses

- Job Tax Credits

- Port Job Tax Credits

- And more

Georgia County Tier Designations

Every year, Georgia’s 159 counties receive a tier designation from the Georgia Department of Community Affairs that is based on various indicators of economic well-being. The tier system is incorporated into many of the state’s incentive programs, most notably the Job Tax Credits, to encourage economic activity in economically distressed areas of the state. The tier rankings range from Tier 1 (most distressed) to Tier 4 (least distressed). The lower the Tier number, the higher the amount of job tax credit is available per job.

To determine the Tier designation of a specific county, please click here.Other Opportunities

Centers of Innovation

A division of the Georgia Department of Economic Development, the state’s six Centers of Innovation provide the leading technical industry expertise, research collaborations, and business partnerships to help the state’s strategic industries connect, compete and grow. The Centers operate statewide with a focus on:

- Aerospace

- Agricultural Technology

- Energy Technology

- Information Technology

- Logistics

- Manufacturing

New Market Tax Credits:

The New Market Tax Credit program was enacted to promote community investment from individuals and companies. The credit is provided to the company or individual that makes a qualified investment with a Community Development Entity (CDE). The invested money must be used by the CDE to provide low interest loans to new business ventures within a qualified census tract.

Access to Foreign Trade Zone (FTZ):

Although not located in a Foreign Trade Zone, Locate South Georgia’s member counties have potential access to FTZ 144. An FTZ is a secured, neutral area outside of U.S. customs territory. Items imported into an FTZ are exempt from duties and excise taxes. Merchandise may be manipulated, used in manufacturing, inspected, combined, displayed for sale, or re-exported without payment of duty. Customs duties and excise taxes are only applied on the final product if/when the product is imported into the U.S.

Opportunity Zones

Several cities and towns in South Georgia have federally designated Opportunity Zones. Economic investment in these areas, which are some of the most distressed communities in the country, may be eligible for preferential tax treatment. These Federal Opportunity Zones are intended to facilitate investment in areas where poverty rates are greater than 20 percent.

Historically Underutilized Business Zones (HUBZones)

Georgia’s Seminole County is a designated HUBZone.

Benefits for HUBZone-certified companies include:

- Competitive and sole source contracting

- 10% price evaluation preference in full and open contract competitions, as well as subcontracting opportunities.

The federal government has a goal of awarding 3% of all dollars for federal prime contracts to HUBZone-certified small business concerns.

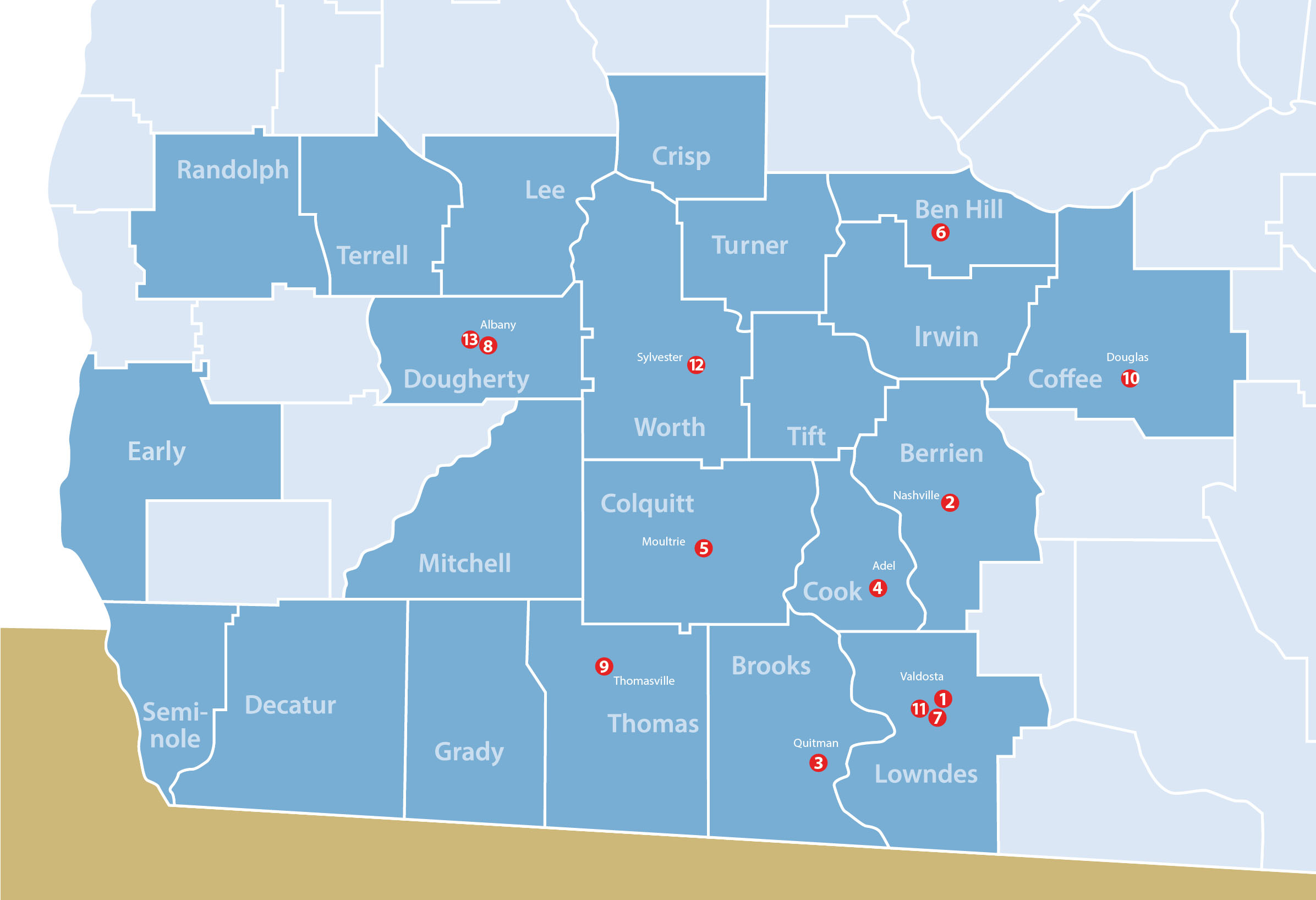

GRAD-Ready Sites

Locate South Georgia currently has 13 sites holding Georgia Ready for Accelerated Development (GRAD) certification. This means LSGA communities have already completed the initial due diligence as to minimum qualified acreage, transportation and accessibility assessments, documented utility services and topographical surveys.

GRAD Sites

- Bassford Industrial Park, Valdosta, Lowndes County

- Berrien Business Park, Nashville, Berrien County

- Brooks County Industrial Park, Quitman, Brooks County

- Cook County Industrial Park, Adel, Cook County

- Citizens Business Park, Moultrie, Colquitt County

- Forward Fitzgerald Site, Fitzgerald, Ben Hill County

- Miller Business Park, Valdosta, Lowndes County

- Pecan Grove Industrial Park, Albany, Dougherty County

- Red Hills Business Park, Thomasville, Thomas County

- Satilla Park, Douglas, Coffee County

- West Side Industrial Park, Valdosta, Lowndes County

- Worth County Industrial Park, Sylvester, Worth County

- Southwest GA Regional Airport, Albany, Dougherty County